proposed federal estate tax changes 2021

The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35. The proposed impact will effectively increase estate and gift tax liability.

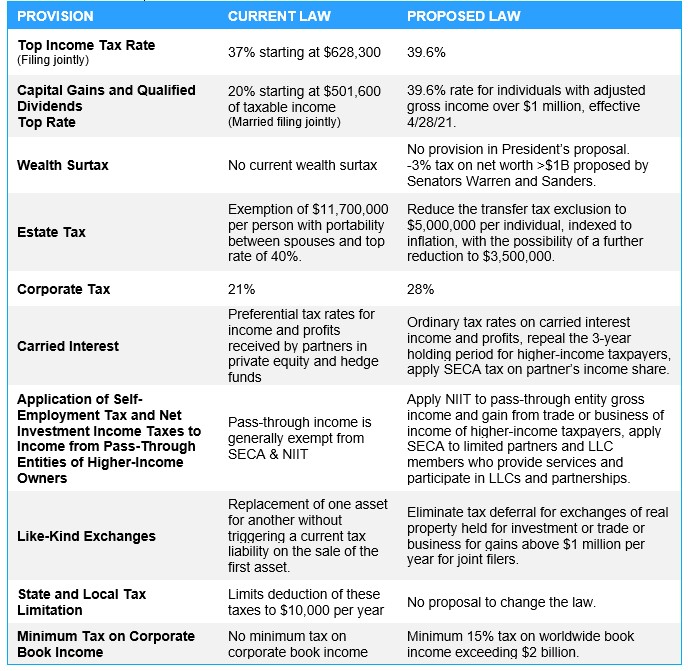

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

On September 13 2021 the US.

. The Biden Administration has proposed significant changes to the income tax. Is 117 million in 2021. As of this writing on.

House Ways and Means Committee the Committee released a draft of proposed changes to the federal tax code including. Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

That is only four years away and. The 117M per person gift and estate tax exemption will remain in place and will be increased. Before December 31 2021 a client without prior gifting can transfer 11700000 without incurring a federal transfer tax and a married couple that agrees to split the gift can.

Lifetime estate and gift tax exemptions reduced and decoupled. The proposed bill would increase the top marginal individual income tax rate to 396 effective after December 31 2021. New federal tax legislation is on the horizon with significant changes for estate and gift taxes.

Together with an estate tax over 25 of the farms net worth would be paid in taxes. Reduce the current 117 million federal ESTATE tax exemption to 35 million. The current 2021 gift and estate tax exemption is 117 million for each US.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for. The taxable estate is taxed at 40.

The Act would also reduce the lifetime gift tax. The transfer tax on this estate would be 3350804. The exemption applies to total.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1. After 2025 with the reduction in the. 2021 Estate Tax Proposals.

The estate tax exemption under the Act would move to 3500000 down from the current exemption of 11700000. This marginal rate would apply to. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

For the vast majority of. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. The maximum estate tax rate would increase from 39 to 65.

As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Read on for five of the most significant proposed changes.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. President Bidens Build Back Better plan currently wending its way through Congress proposes to drastically cut the estate and gift tax exemption and make estate and gift tax planning much more difficult.

The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure.

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

2022 Tax Inflation Adjustments Released By Irs

What Are Marriage Penalties And Bonuses Tax Policy Center

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

2020 Income Tax Withholding Tables Changes Examples Income Tax Tax Brackets Filing Taxes

How The Tcja Tax Law Affects Your Personal Finances

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Tax Law Changes What To Do Now

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

How Did The Tcja Change Taxes Of Families With Children Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center